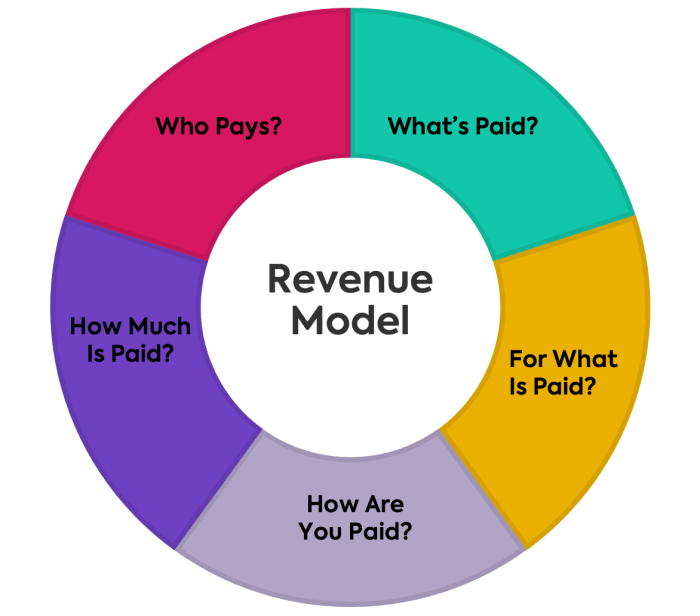

Understanding the nuances between a business model and a revenue model is crucial for any organization aiming for sustainable growth. While often used interchangeably, these concepts represent distinct yet interconnected aspects of a company’s strategy. A business model Artikels the entire value creation and delivery process, encompassing target customers, value propositions, and key activities. Conversely, the revenue model focuses specifically on how the business generates income, encompassing pricing strategies, payment methods, and revenue streams.

This exploration delves into the intricacies of each, highlighting their interdependence and impact on overall success.

This analysis will examine various business models—from subscription-based services to freemium offerings and affiliate marketing—and their corresponding revenue streams. We’ll explore how a shift in market conditions or strategic goals might necessitate adjustments to both the business and revenue models. Furthermore, we’ll discuss the critical role of business development in identifying new revenue streams and optimizing existing ones, while considering the ethical implications of revenue generation strategies.

Funding and Business Models

Securing adequate funding is crucial for successfully implementing a new business model. A well-defined business model, outlining the value proposition, target market, and revenue streams, is essential for attracting investors and lenders. However, the initial capital needed to launch and scale a new business model often exceeds the resources of founders, necessitating external funding sources, with business loans playing a significant role.Business loans provide a vital injection of capital that allows entrepreneurs to bridge the gap between their vision and operational reality.

This funding can be used to cover various aspects of a business model’s implementation, from initial product development and marketing campaigns to expansion into new markets and the hiring of key personnel. The availability and type of loan often depend on the business’s stage of development, creditworthiness, and the specific needs of the business model.

Types of Business Loans and Their Applications

Different types of business loans cater to different stages and aspects of business development. Term loans provide a fixed amount of money for a specified period, often used for purchasing equipment, real estate, or covering significant upfront costs associated with a new business model. Lines of credit, on the other hand, offer flexible access to funds as needed, useful for managing fluctuating operational expenses or seasonal demands.

Short-term loans, typically with higher interest rates, can provide immediate capital for urgent needs, while SBA loans offer government-backed support, making them attractive for smaller businesses or those with limited credit history. The choice of loan type depends on the specific needs of the business model and its financial projections. For example, a business launching a new SaaS product might utilize a term loan for initial software development and a line of credit to manage ongoing marketing and customer acquisition costs.

Examples of Successful Loan Utilization

Many businesses have successfully leveraged business loans to scale their operations and enhance their revenue models. Consider a hypothetical example of a food truck business implementing a new business model that incorporates online ordering and delivery. A term loan could fund the purchase of a new, larger food truck equipped for efficient online order fulfillment. A line of credit could then be used to manage fluctuating demand during peak hours and seasons, covering additional staffing and ingredient costs.

Similarly, a startup developing a unique e-commerce platform might use a venture debt financing to cover initial development and marketing, using the platform’s future revenue stream as collateral. These examples highlight how strategically secured loans can fuel growth and innovation within a new business model.

Financial Considerations When Securing a Business Loan

Before seeking a business loan, careful planning and financial analysis are essential. The following points should be considered:

- Credit Score and History: A strong credit score significantly improves loan approval chances and secures favorable interest rates.

- Detailed Business Plan: A comprehensive business plan outlining the business model, market analysis, financial projections, and loan utilization strategy is crucial.

- Collateral: Lenders often require collateral to secure the loan, which could include assets like equipment, inventory, or real estate.

- Loan Terms and Interest Rates: Carefully compare loan terms, interest rates, and repayment schedules from different lenders to secure the most favorable option.

- Debt-to-Income Ratio: Maintaining a healthy debt-to-income ratio demonstrates financial responsibility and increases the likelihood of loan approval.

- Cash Flow Projections: Accurate cash flow projections demonstrate the business’s ability to repay the loan and are vital for securing funding.

Business Travel and its Relation to Revenue Generation

Business travel, while often perceived as a cost, is a significant driver of revenue for many businesses. Its contribution varies greatly depending on the industry and the specific business model employed. Understanding this relationship is crucial for optimizing travel strategies and maximizing profitability.Business travel facilitates direct revenue generation through client meetings, contract negotiations, and relationship building. It also supports indirect revenue generation by fostering collaboration, innovation, and knowledge sharing, leading to improved product development and enhanced market penetration.

Industries Where Business Travel is Crucial for Revenue Generation

Several industries rely heavily on business travel for revenue generation. These industries often involve face-to-face interactions crucial for building trust, closing deals, and providing personalized services. The absence of in-person engagement could significantly hinder their ability to secure and maintain business.

- Sales and Marketing: Sales representatives frequently travel to meet with potential clients, present products or services, and build relationships. This direct engagement often leads to immediate sales and long-term contracts.

- Consulting: Consultants often travel to client sites to provide on-site services, conduct workshops, and build strong working relationships. The personal interaction strengthens client trust and leads to repeat business.

- Real Estate: Real estate agents often show properties to potential buyers and work with clients in person to facilitate transactions. Travel is integral to the sales process.

- Manufacturing and Supply Chain: Businesses in these sectors often travel to meet with suppliers, oversee production processes, and manage logistics. These trips are vital for ensuring smooth operations and timely delivery.

Cost-Benefit Analysis of Business Travel and Revenue Generation

A comprehensive cost-benefit analysis is essential to justify business travel expenses. Costs include airfare, accommodation, transportation, and employee time. Benefits encompass direct sales generated, new business opportunities secured, and improved client relationships. A successful analysis requires quantifying both costs and benefits to determine the return on investment (ROI). For example, a company might track the revenue generated from deals closed after in-person client meetings, comparing this to the cost of the trips.

A positive ROI demonstrates the value of the investment in business travel.

Efficient Business Travel Management and its Impact on the Bottom Line

Effective management of business travel significantly impacts profitability. Strategies such as optimizing travel routes, negotiating favorable rates with airlines and hotels, utilizing travel management software, and implementing clear travel policies can reduce costs without compromising the effectiveness of the trips. These measures directly contribute to a higher ROI on business travel and ultimately improve the company’s bottom line.

For instance, implementing a travel booking system that automatically compares flight and hotel prices can lead to significant savings over time. Furthermore, clear travel policies that promote responsible spending can prevent unnecessary expenses.

Ultimately, the success of any enterprise hinges on a well-defined and strategically aligned business and revenue model. Understanding the interplay between these two elements empowers businesses to make informed decisions, adapt to changing market dynamics, and achieve long-term profitability. By carefully considering target markets, value propositions, operational activities, and diverse revenue streams, organizations can build robust, sustainable, and ethically sound business models that drive growth and success.

The key takeaway is the need for continuous evaluation and adaptation to ensure the chosen models remain relevant and effective in a dynamic business environment.

Questions and Answers

What is the difference between a business model and a revenue model in simple terms?

A business model describes

-how* your company creates, delivers, and captures value. A revenue model describes

-how* your company makes money.

Can a business have multiple revenue models?

Yes, many businesses utilize multiple revenue models to diversify income streams and reduce risk. Examples include a SaaS company offering both subscription and consulting services.

How often should a business review its revenue model?

Regularly, ideally annually, or more frequently if market conditions change significantly or performance significantly deviates from projections.

What are some common pitfalls to avoid when designing a revenue model?

Overlooking customer needs, neglecting market research, relying solely on a single revenue stream, and failing to consider ethical implications are common pitfalls.